Credit Card

Background

A credit card allows consumers to purchase products or services without cash and to pay for them at a later date. To qualify for this type of credit, the consumer must open an account with a bank or company, which sponsors a card. They then receive a line of credit with a specified dollar amount. They can use the card to make purchases from participating merchants until they reach this credit limit. Every month the sponsor provides a bill, which tallies the card activity during the previous 30 days. Depending on the terms of the card, the customer may pay interest charges on the amount that they do not pay for on a monthly basis. Also, credit cards may be sponsored by large retailers (such as major clothing or department stores) or by banks or corporations (like VISA or American Express).

Credits cards are a relatively recent development. The VISA Company, for example, traces its history back to 1958 when the Bank of America began its BankAmericard program. In the mid-1960s, the Bank of America began to license banks in the United States the rights to issue its special BankAmericards. In 1977 the name Visa was adopted internationally to cover all these cards. VISA became the first credit card to be recognized worldwide.

The banks and companies that sponsor credit cards profit in three ways. Primarily they make money from the interest payments charged on the unpaid balance, but they also can make money by charging an annual fee for the use of the card. The income from this fee, which is typically only $50 or $75 per customer per year, can be substantial considering that the larger companies have tens of millions of customers. In addition, the sponsors make money by charging merchants a small percentage of income for the service of the card. This arrangement is acceptable to the merchants because they can let their customers pay by credit card instead of requiring cash. The merchant makes arrangements to participate in a credit card program with a merchant bank, which in turn works with a card-issuing bank. The merchant bank determines what percentage of the total purchase value has to be paid by the merchant to the card-issuing bank. The amount varies depending on the volume and type of business, but in general it is between 1-2%. A percentage of that amount is kept by the merchant bank as a transaction-processing fee. For companies like American Express which sponsor cards, the processing fee may be significantly higher. Furthermore, sponsors may generate income by leasing credit card verification equipment to merchants (especially if the merchants can not afford to purchase the equipment themselves.) Finally, sponsors may profit by charging service fees for late payments.

Design

Credit cards are designed with complex security features to prevent the possibility of fraud. These features involve the card's account number, its signature panel, and its magnetic stripe. The card's unique account number is the key piece of information needed to conduct a financial transaction and must be carefully protected. To prevent someone from using a wrong account number, or from making up a phony number, companies rely on the laws of statistics for protection. By using long account numbers they make it unlikely that a number can be faked. For example, the Visa card has 13 digits, American Express has 15, Diners Club 14, and MasterCard has 20. Mathematically, nine digits would provide one billion unique account numbers (000000000, 000000001, 0000000002, and so forth up to 999999999) which would be enough for all the customers of a given company. (The largest companies, Visa and MasterCard, only have about 65 million customers.) If only 65 million numbers are assigned out of a possible 10 trillion possibilities, it is unlikely that anyone will be able to mistakenly use another account number. If an incorrect account number is mistakenly entered by a store clerk, it will almost certainly not be accepted. This statistical security gives companies confidence that someone is not making up a number when conducting business over the phone. Of course, this security measure does not help if someone obtains a real number and uses it fraudulently.

Another security design feature involves the signature panel on the back of the card. The signature is intended to document the owner's handwriting so a forged signature on a receipt can be detected. To prevent criminals from erasing the back panel of a stolen card and putting on their own signature, the panel is printed with a fingerprint design that is difficult to duplicate and that will come off when the original signature is erased. If the signature is erased, this design will disappear too leaving a white spot, which instantly indicates the card has been tampered with. Some card manufacturers imprint the word VOID beneath this panel, which is revealed upon erasure.

The magnetic stripe on the back of the card is a third security feature. The stripe is an area coated with particles of iron oxide that can be encoded with binary information, which identifies the card as authentic. It is difficult to determine exactly what information is coded on the strip because for security reasons companies do not wish to discuss this. However, it is likely that the card's expiration date is one fact recorded on the strip because automatic teller machines (ATMs) will retain cards that have expired. It is unlikely that information like credit limit, address, phone number, employer, is recorded on the stripe because banks do not reissue cards when this type of information changes.

Finally, some cards feature special features that make them hard to duplicate, such as complicated holograms.

Raw Materials

Cards are made of several layers of plastic laminated together. The core is commonly made from a plastic resin known as polyvinyl chloride acetate (PVCA). This resin is mixed with opacifying materials, dyes, and plasticizers to give it the proper appearance and consistency. This core material is laminated with thin layers of PVCA or clear plastic materials. These laminates will adhere to the core when applied with pressure and heat.

A variety of inks or dyes are also used for printing credit cards. These are available in a variety of colors and are designed for use on plastic substrates. Some manufacturers use special magnetic inks to print the magnetic stripe on the back of the card. The inks are made by dispersing metal oxide particles in the appropriate solvents. Additional special printing processes are involved for cards, like VISA, which feature holograms.

The Manufacturing

Process

The manufacturing process consists of multiple steps: first the plastic core and laminate materials are compounded and cast into sheet form; then the core is the printed with appropriate information; next the laminates are applied to the core; and finally the assembled sheet is cut into individual cards.

Plastic compounding and molding

-

1 The plastic for the core sheet is made by melting and mixing polyvinyl

chloride acetate with other additives. The blended components are

transferred to an extrusion molding apparatus, which forces the molten

plastic through a small flat orifice known as a die. As the sheet exits

the die, it goes through a series of three rollers stacked on top of

each other that pulls the sheet along. These rollers keep the sheet flat

and maintain

the proper thickness. The sheets may then pass through additional cooling units before being cut into separate sheets by saws, shears, or hot wires. The cut sheets enter a sheet stacker that stacks them into place and stores them for subsequent operations.

As the sheet exits the die, it goes through a series of three rollers stacked on top of each other that pulls the sheet along. These rollers keep the sheet flat and maintain the proper thickness. The sheets may then pass through additional cooling units before being cut into separate sheets.

As the sheet exits the die, it goes through a series of three rollers stacked on top of each other that pulls the sheet along. These rollers keep the sheet flat and maintain the proper thickness. The sheets may then pass through additional cooling units before being cut into separate sheets. - 2 The laminate films used to coat the core stock are made by a similar extrusion process. These thinner films may be made with a slot cast die process in which a molten plastic film is spread on a casting roller. The roller determines the film's thickness and width. Upon cooling the films are stored on rolls until ready for use.

Printing

- 3 The plastic core of the card is printed with text and graphics. This is done using a variety of common silk screen processes. In addition, one of the laminate films may also undergo subsequent operations where it is imprinted with magnetic ink. Alternately, the magnetic stripe may be added by a hot stamping method. The magnetic heads used to code and decode the iron oxide particles can only operate if the magnetic medium is close to the surface of the card, so the metal particles must be placed on top of the laminating layer. Upon completion of the printing process, the core is ready to be laminated.

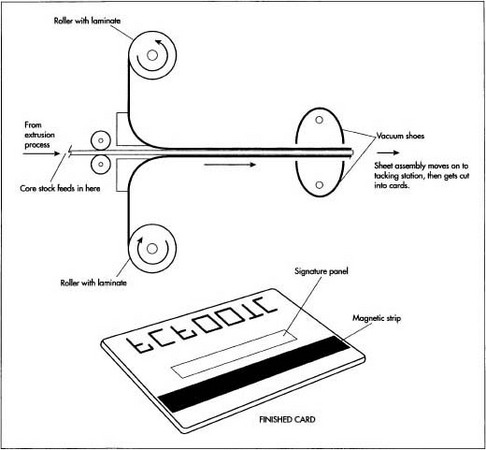

Lamination

- 4 Lamination helps protect the finish of the card and increases its strength. In this process, sheets of core stock are fed through a system of rollers. Rolls of laminate stock are located above and below the core stock. These rolls feed the laminate into the vacuum shoes along with the core stock. The vacuum holds the three pieces of plastic together while they travel to a tacking station. At the tacking station a pair of quartz infrared heat lamps warm the upper and lower plastic films. These lamps are backed with reflectors to focus the radiant energy onto a narrow area of the films, which optimizes a smooth bonding of the film to the core stock. The laminate films are then fully bonded to the core stock by pressing with metal platens, which are heated to 266° F (130° C) and applied with a pressure of 166 psi/sq inch. This lamination process may take up to 3 minutes.

Die cutting and embossing

- 5 After lamination has been completed, the finished assembly is cut and completed by die cutting methods. Each assembly yields a sheet, which is cut into 63 credit cards. This is achieved by first cutting the assembly longitudinally to form seven elongated sections. Each of the seven sections is then cut and trimmed to form nine credit cards. In subsequent operations, the card is embossed with account numbers. The finished cards are then prepared for shipping, usually by attaching the card to a paper letter with adhesive.

Quality Control

Key quality issues are associated with the compounding of plastic and color matching of the inks. The American National Standards Institute has a standard for plastic raw materials (ANSI specification x4.16-1973). As with any compounding procedure, ingredients must be properly weighed and mixed and blended under the appropriate temperature and sheer conditions. Similarly, the molding process must be monitored to avoid defects, which could cause the cards to crack or break. The final quality check is to make sure the correct numbers are stamped on the cards during the embossing process.

The Future

Future credit card manufacturing processes are likely to evolve in three key areas. First, continued improvements in plastic chemistry and molding technology are likely to allow cards to be made increasingly cheaper and easier. Second, breakthroughs in digital technology are likely to improve the way credit cards are kept secure with advanced magnetic coding. One recent advance is the use of a new generation of magnetic stripes which are harder to duplicate. This improvement combats the trend toward duplicating card information and copying it to phony cards. Perhaps even more importantly, new generations of credit cards will carry integrated computer chips, containing a variety of useful information. For instance, these future cards will be able to operate a frequent flyer program on the same card as a debit or credit account. Other services will allow users to participate in frequency or loyalty programs with merchants, including storing hotel reservation preferences. Financial institutions may develop partnerships with local mass transit systems so public transit could be paid for with these "smart" cards in various cities throughout the world. Third, marketing initiatives resulting from these advances in card technology are likely to make credit cards even more pervasive in society. For example, American Express has just launched a new Blue card that is expected to reach new levels of worldwide acceptance.

Where to Learn More

Books

Poundstone, William. Big Secrets. New York: William Morrow & Co., 1983.

Sutton, Caroline and Kevin Markey. More How Do They Do That? New York: William Morrow & Co., 1993.

Other

U.S. Patent 4,100,011. "Production of Laminated Card with Printed Magnetically Encodable Stripe," issued 1978.

Visa International. http://www.visa.com (May 12, 1998).

— Randy Schueller